And another excuse Xero works nicely for on-line sellers? It consists of stock management with each plan—even its most cost-effective, which costs simply $13 a month. When it comes to enterprise finance, freelancers and different small-business owners have a lot in frequent. Each teams have to stability their books, track expenses, and receives a commission on time. But freelancers have distinctive bookkeeping needs that don’t at all times apply to other small-business house owners, particularly in phrases of tax obligations. However should you want more features, together with financial institution reconciliation, you may need Kashoo’s https://www.intuit-payroll.org/ $2/yr.

Keeping observe of receipts and invoices is crucial for accurate bookkeeping. Receipts and invoices are a document of the monetary transactions that happen inside your corporation, that are important for getting ready tax returns and other financial reports. It is necessary to maintain receipts and invoices organized and easily accessible for reference. Recording earnings and bills is a key facet of bookkeeping.

- Correct financials allow you to understand your financial well-being.

- If you’ve been putting off getting your finances in order, now’s the right time to start.

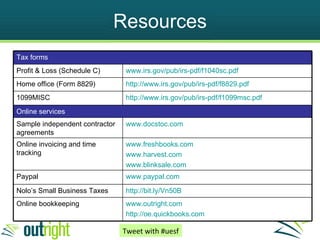

- A buyer is required to file and send you a replica of Type 1099-MISC whenever you accomplish work for them that prices greater than $600.

- In an increasingly global market, many freelancers work with international shoppers.

- That’s the place specialized bookkeeping providers for freelancers can make a real distinction.

- Under common business accounting circumstances, income recognition is easy as a result of they promote a services or products and acquire a fixed value instantly.

For instance, construction contractors might choose a devoted development product like Sage 100 or Jonas Premier. At the same time, industry-specific software program tends to price greater than fundamental freelancing software program. It’s also built for more customers with complex group wants.

In this guide, we’ll break down everything you have to know about managing your funds as an independent contractor, from tax duties to best bookkeeping practices. FreshBooks has a couple of drawbacks, and so they’re fairly big. For one, whereas your invoices are unlimited, your purchasers aren’t.

Step Three: Select An Accounting Methodology: Cash Or Accrual

Flip your receipts into knowledge and deductibles with our expense reports, including IRS-accepted receipt images. Over a million businesses have automated their expense and doc administration with Shoeboxed. When monitoring bills, the IRS considers a business expense anything necessary and strange to the enterprise. Impartial contractors should pay self-employment taxes and revenue tax. For a greater understanding of how transactions are tracked, check out our article on What is a Ledger Balance?. This prevents duties from piling up and ensures your data are at all times present.

Integrating Bookkeeping Tools With Different Business Systems

With plans starting at $15 a month, FreshBooks is well-suited for freelancers, solopreneurs, and small-business house owners alike. The software immediately will get to work studying your bills and begins automating accounting duties proper off the bat. QuickBooks Self-Employed tracks your miles for easier tax reimbursement at the finish of the yr. Its expense categorization additionally simplifies tax deductions, and the software’s quarterly tax estimates maintain you on top of fees so you aren’t caught off guard come April. Unbiased contractors that expect to owe the IRS no less than $1,000 in taxes on the finish of the 12 months should file quarterly estimated tax payments.

How Am I Able To Handle Irregular Earnings For Smoother Financial Planning?

The “independent” in independent contractor simply refers to the fact that the contractor is a non-employee, and is unbiased of the company they’re doing the contracted work for. Study the method to build, learn, and use financial statements for your small business so you can make more knowledgeable decisions. Bench simplifies your small business accounting by combining intuitive software program that automates the busywork with actual, skilled human assist. Yes, freelancers should use accounting software for a couple of key reasons.

This includes tracking clients’ payments and any deposits made into your business bank account. This information is critical for managing cash circulate and preparing tax returns. Understanding bookkeeping for freelancers and impartial contractors isn’t any simple feat, but with diligence, organization, and the right tools, it could be a easy and manageable process. Take the reins of your financial journey at present; it’s one of the best investments you can even make in your freelance career.

Wave also doesn’t combine with many third-party apps. If you manage clients and inventory with monetary tools apart from Wave, you’ll likely spend extra time on redundant information entry than you’d like. Hiring a bookkeeper will provide you with extra time to focus on rising your business. Additionally, business consulting can provide important bookkeeping providers, financial planning, and well timed recommendation to help you develop your corporation. Bookkeeping is crucial to running a profitable business as an independent contractor.

Then, you’ll want to place them into their proper categories and sub-accounts (utilities, rent, and so forth.). Bookkeepers keep your monetary information up to date and organized. Accountants step in to make sure every little thing adds up, especially when it’s time to file taxes or make strategic financial choices.

If there’s an audit, you won’t be ready to assist your expenditures if you don’t have the necessary paperwork. Keep your give attention to rising your small business whereas we handle all your accounting wants seamlessly. Bookkeeping is among the important steps in path of good financial management. It is a crucial process companies and individuals must bear for correct and arranged finances. Our staff of licensed bookkeepers are dedicated to making sure that your corporation finances are accurate and up-to-date. Even with the most effective intentions, freelancers can fall into widespread bookkeeping traps.